does oklahoma have an estate or inheritance tax

Consult a certified tax professional with any tax-related questions Oklahoma. Our state web-based blanks and crystal-clear recommendations remove human-prone mistakes.

Oklahoma Estate Tax Everything You Need To Know Smartasset

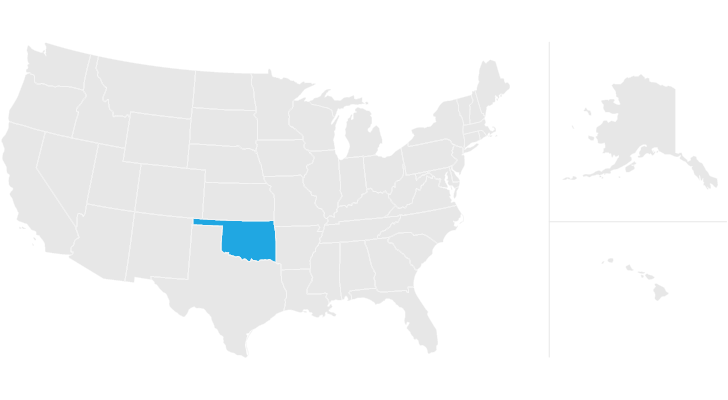

No estate tax or inheritance tax.

. Oklahomas Tax Laws Since January 1 2010 there has been no estate. If you inherit from someone who. Inheritance tax rates typically begin in the single digits and rise to a max of anywhere between 15 and 19.

Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the. Connecticuts estate tax will have a flat rate of 12 percent by 2023. Very few people now have to pay these taxes.

The federal estate and gift tax. Consult a certified tax professional with any tax-related questions Oklahoma does not have an inheritance tax. Heres a quick summary of the new gift estate and inheritance changes that came along in 2022.

Unlike an inheritance tax an estate tax is levied on the entire taxable. Since January 1 2005 Arkansas has not collected a state-level estate or inheritance tax. The role of gift taxes in oklahoma.

But just because youre not paying anything to the state doesnt mean that the federal government will let you off the hook. Inheritance Tax Oklahoma Estate Tax Estate Planning Lawyer How To Avoid Inheritance Tax 8 Different Strategies Financebuzz State Estate And Inheritance Taxes Itep. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up.

Now creating a Oklahoma Estate Tax Return takes no more than 5 minutes. The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that. Lets cut right to the chase.

Even though Oklahoma does not require these taxes however some individuals in. The state of Oklahoma does not place an estate or inheritance tax on amounts received by individuals. The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that.

Does Oklahoma Have an Inheritance Tax or Estate Tax. If you live in oregon you can be.

Oklahoma Estate Tax Everything You Need To Know Smartasset

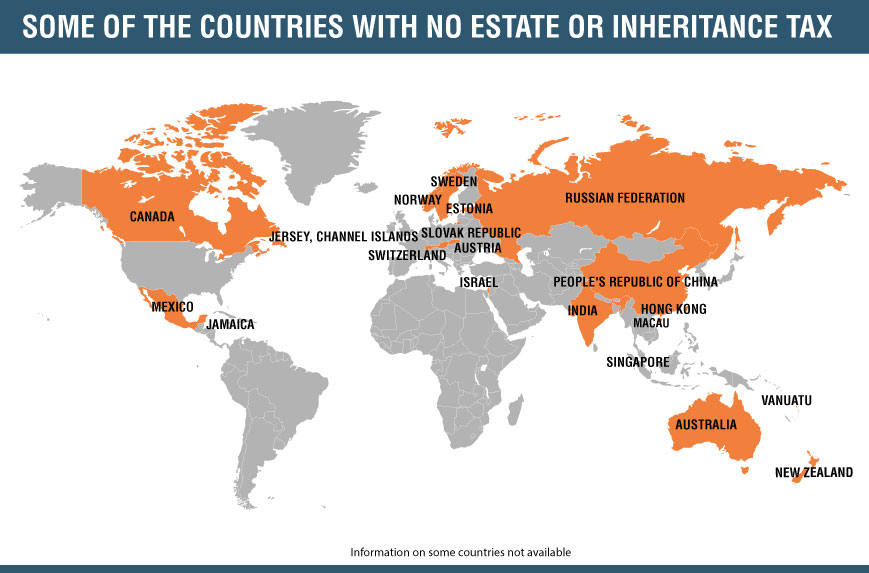

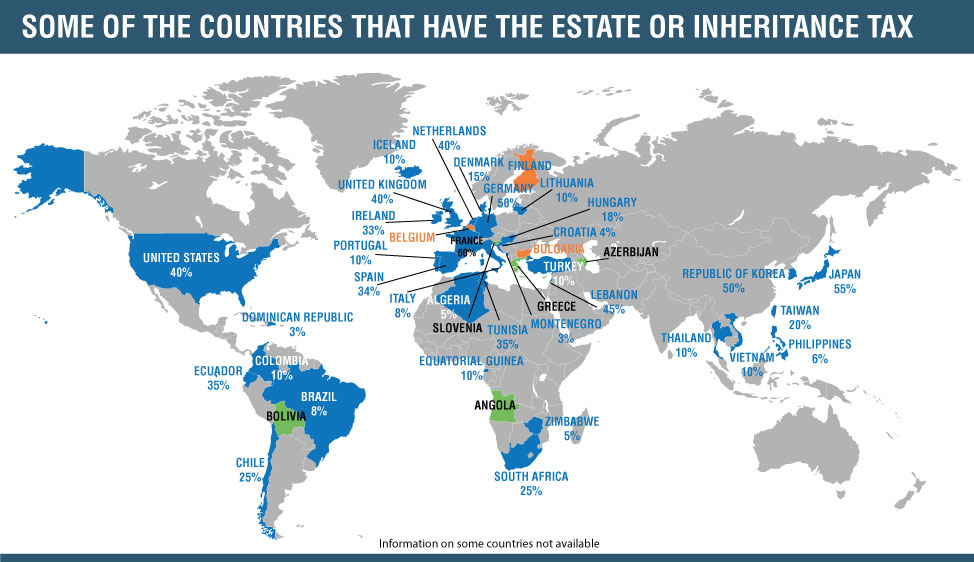

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Oklahoma Estate Tax Everything You Need To Know Smartasset

Estate Planning Attorney Estate Planning Estate Planning Attorney How To Plan

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Last Will Testament Templates Poster Template Last Will And Testament Will And Testament Business Letter Template

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

States With No Estate Tax Or Inheritance Tax Plan Where You Die

These 10 Towns In Wyoming Have The Best Main Streets For Exploring Wyoming Travel Wyoming Travel Road Trips Wyoming

We Buy Houses Oklahoma Close In 7 Days Any Condition Fast Ca H Easy Sell

Second Marriage Estate Planning Tulsa Estate Planning Kania Law

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Last Will Testament Templates Poster Template Last Will And Testament Will And Testament Business Letter Template

State Estate And Inheritance Taxes Itep

Do I Need To Pay Inheritance Taxes Postic Bates P C

How Do State Estate And Inheritance Taxes Work Tax Policy Center